By Chom Greacen

If you find the electricity rate increases, 12 percent this year and 41 percent by 2019, alarming, what’s behind the rising rate is worse.

Given OPALCO’s broadband busy-ness lately, how much of the rate increase is due to broadband? OPALCO’s answer is only an average of $3/member/month for 24 months, roughly $1 million total.

So, what explains the sudden need for 41 percent increase in revenues or $28 million in accumulated total by 2019? The explanation we often hear from OPALCO is 1: warming temperatures, and 2: the submarine cable between Lopez and San Juan.

By OPALCO’s estimate, warmer temperatures 2014 caused a $1.4 million revenue shortfall, a tiny sum compared to $28 million. The $15 million price tag for the submarine cable is a big surprise compared with earlier estimates of $3.5 million, but when amortized over 30 years at 3 percent, contributes only $759,000 to OPALCO’s annual expense.

In contrast, the increase in revenue requirement in 2015 is $2.7 million. What else lies behind the rate increases? The answer, I believe, is “grid control backbone,” OPALCO’s code word for fiber-optics infrastructure.

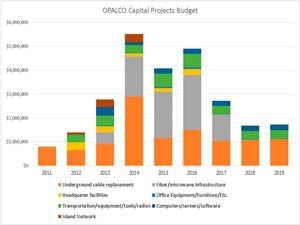

The obscure terminology is a convenient tool in diverting attention away OPALCO’s foray into broadband, portraying the rate increases as an unavoidable need on the electrical side. A close inspection of OPALCO’s 2015 budget reveals curious patterns: “electrical business” items on OPALCO’s capital projects budget happen to skyrocket or suddenly manifest in tandem with the startup of the broadband business (see graph).

Rapid rise in costs

For example, “under-ground cable replacement” (read: fiber optics trenching) expenditure in 2014 quadrupled that of pre-broadband years. The appearance of new line items such as “headquarter facilities” (office expansion) or “computers/servers/software” coincided with OPALCO’s venture into broadband.

line items such as “headquarter facilities” (office expansion) or “computers/servers/software” coincided with OPALCO’s venture into broadband.

And, so did the $7.5 million expenditure on “fiber/microwave infrastructure.” These items add up to over $25 million, dwarfing the $15 million submarine cable.

Besides capital expenditures, the “electrical” operations budget is also skyrocketing. “Member communications” (PR machine) expenses have more than doubled and will triple, and so will “grid control communication design” expenses. Two communication technicians positions and an apprentice were just added to the (electric) operations department this year.

Perhaps these rising costs are partially justified and cost-effective from the electrical perspective. Still, questions remain. How much of these budgeted costs are beyond electrical necessity? And, will there be more to come?

OPALCO’s attempt to hide its charitable but costly act of “facilitating” broadband under the “electrical” rug not only causes hardships on membership, but also violates our trust. The cost of OPALCO’s current broadband adventure seems not that different from the failed broadband plan that OPALCO put forward to the membership two years ago.

The key differences are: two years ago, we at least had a chance to see the business plan with known impacts on the rates ($15/member/month across membership plus additional fees for subscribers), and we were given the opportunity to vote “yay” or “nay” with our checkbook. Now, there is very little transparency of information regarding OPALCO’s broadband costs, plans and rate impacts.

The electricity fixed charges have been approved to rise to $78/month by 2019, an increase of $50/member/month from 2014. Worse, the member-owners have no say this time: it’s either pay up or have electricity disconnected because it is no longer affordable.

Running into the red

What is more alarming is that rising costs and investments, including OPALCO’s provision of a $7.5 million loan to the new broadband company, have pushed OPALCO financially close to the brink.

For the first time in four decades, OPALCO was unable to meet a loan interest coverage ratio (called “TIER”) and thus violated its loan covenants. It took OPALCO 40 years to bring TIER up to above 5 (very healthy). To let TIER slide below the required minimum of 1.25 in three years is quite a blunder.

To appease its lender, the OPALCO Board approved a “cost recovery charge” mechanism whereby future shortfalls in revenues will be calculated monthly and recovered through increases in the monthly fixed-charge on every members’ bill. Doesn’t this seem like a “blank check”?

OPALCO is on a dangerous, slippery slope. In hindsight, it was no surprise two financially savvy directors resigned from the board a few years ago.

Has the OPALCO leadership of the past three years essentially led the co-op astray? Has the membership been kept in the dark, fed partial truths, excluded from important decisions, brought to a financial cliff-edge, and now “asked” for a blank check?

Affordability of electricity service, financial prudence and good governance have been mainstays of OPALCO management, but are now tossed aside. For what? For whom?

The point here is not to question the merit of broadband or OPALCO’s role in its provision. The issues are transparency, accountability, risks, and future of our electric co-op. It is time members ask questions and demand straight answers from the board and management.

Come and attend the OPALCO candidate forums: Tuesday April 7, 5 p.m. at Lopez Library and Thursday April 9, 7 p.m. at Orcas Library. For the upcoming election of two OPALCO board positions and Annual Meeting on May 2, make your vote count and voice heard.

— Editor’s note: An independent energy researcher, Chom Greacen is co-founder of a Thailand-based watchdog group focused on energy issues in southeast Asia. She lives on Lopez Island with her husband and two children. Read her earlier column about the impact on the recent rise in electrical rates here.