Submitted by the Washington State Budget and Policy Center

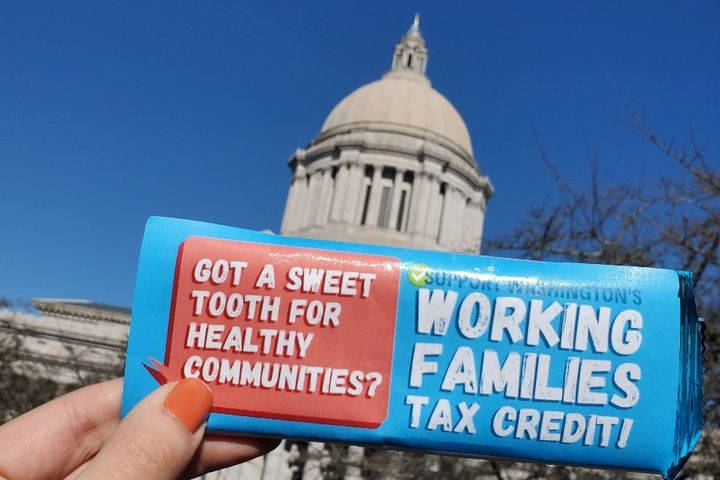

Rep. My-Linh Thai, D-41, and Rep. Drew Stokesbary, R-31, submitted House Bill 1297 on Jan. 18 calling for an updated Working Families Tax Credit, or Recovery Rebate, in Washington state. As the economic fallout of the pandemic continues to leave many people unable to make ends meet, the need for the Working Families Tax Credit is more important than ever before. Community members and organizations from throughout the state are increasingly calling on lawmakers to support this policy.

The updated Working Families Tax Credit provides annual state cash stimulus to families who are struggling to afford the basics. It offers a base credit amount of $500 to eligible people, with additional funds for households with children. The legislation also importantly includes taxpayers who file taxes using an Individual Tax Identification Number — including undocumented people, students, and some survivors of domestic violence who are unjustly excluded from federal tax credits and stimulus efforts.

The Recovery Rebate would go to approximately 500,000 Washington households – the same people who qualify for the successful federal anti-poverty program, the Earned Income Tax Credit, as well as ITIN filers who are excluded from the EITC. It would provide a much-needed lifeline to people whose employers have laid them off, whose small businesses are struggling, and who otherwise are unable to pay for the basics.

As small business owner Chevon told the Budget and Policy Center, “I’m an event planner, and because of COVID, all my revenue streams dried up overnight. For small business folks – especially during this time — this sort of access [to cash] is crucial to focus on what we want to build.”

A bipartisan group of 46 House members (40 Democrats and six Republicans) signed on to this bill. By passing and funding an updated Working Families Tax Credit, lawmakers can:

• Advance racial and economic justice: The rebate would provide a larger share of benefits to Black, Indigenous, and people of color (BIPOC), who have been most harmed by longstanding barriers to wealth and opportunity (due to racist policies like redlining and discrimination in banking), as well as the pandemic’s economic crisis. BIPOC tax filers make up 36 percent of those eligible for the credit in comparison to 25 percent of the state’s population.

• Speed up the state’s economic recovery: Small businesses do better when people have money to spend in their communities. State tax credits like the updated Working Families Tax Credit have been estimated to infuse $1.50 to $2 into local economies for every dollar a recipient receives.

• Promote community health: People are healthier when they are not worried about how to make ends meet. Tax credits have been linked to improved health outcomes for recipients and their families, from improved mental health to healthier moms and birthing parents and their babies.

• Fill gaps in existing support systems: A Recovery Rebate would work alongside existing public assistance programs to weave a stronger network of public support. It fills an important gap by reaching people who are struggling to pay bills but may not qualify for other federal and state assistance programs.

“The kind of cash support the Recovery Rebate provides was needed long before the pandemic,” said Budget and Policy Center Policy Analyst Margaret Babayan, who provided policy expertise in drafting House Bill 1297. “People with low and moderate incomes already had a hard time making ends meet, especially Black, Indigenous, and people of color who’ve long faced barriers to wealth because of racist policies. It is essential in this moment that lawmakers address these systemic inequities and provide this direct, flexible cash to people who need it.”

This bill is endorsed by a broad coalition of more than 35 organizations that advocate for anti-poverty, workers’ rights, racial equity and social justice, small business advancement, health care access, rural and urban economic and community development, and tax reform.

Sen. Joe Nguyen, D-34, will be submitting the Senate companion bill soon. See further analysis on the bill at https://budgetandpolicy.org/schmudget/washington-state-needs-a-recovery-rebate-now/.