By Cassie Diamond

WA State Journal

Kristopher Shook said he never imagined he would be diagnosed with two types of stage 4 cancer at the same time.

As he underwent lifesaving treatment, Shook accrued hundreds of thousands of dollars in medical debt. A 12% interest rate was added in 2019 after he was unable to pay off the debt in two years.

“I have been served, I’ve been threatened with lawsuits, wage garnishment, and court action,” Shook said. “I’ve had to explain to attorneys that I am just not some schmuck who decided not to pay any debt or refused to pay. How was I being penalized for beating cancer?”

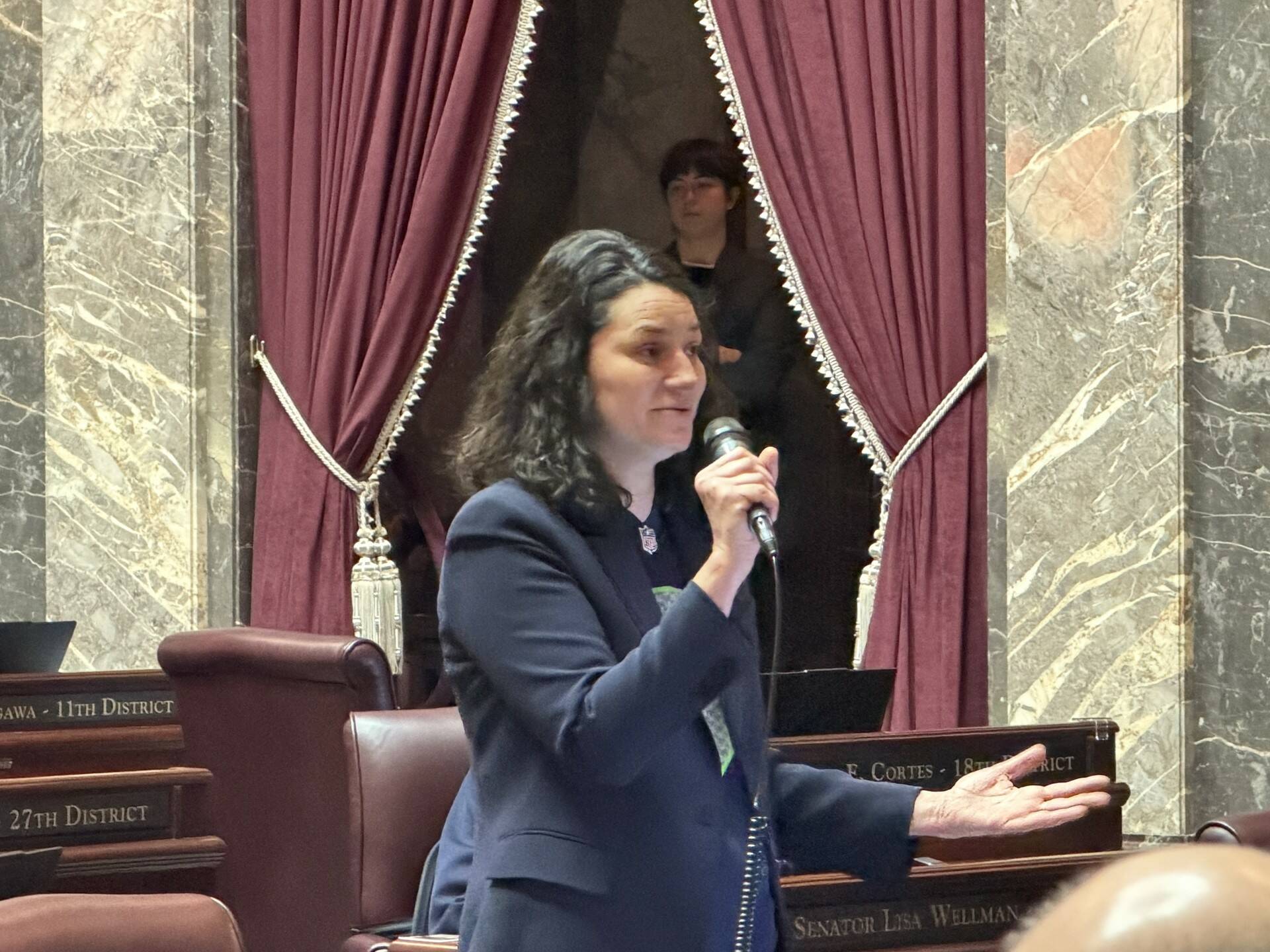

Stories like this are why Sen. Emily Alvarado, D-Seattle, introduced Senate Bill 5993, which would limit interest charges on medical debt to a simple 1% interest rate per year.

To Alvarado, Washington’s current prejudgment medical debt interest cap of 9% is a “penalty” inflicted on those who are unable to plan for unpredictable medical issues.

With her proposed measure, Alvarado said she aims to prevent families from spiraling into debt.

“Families still need to pay,” she said, “but we give a little relief so they have some more financial awareness and ability to pay as they recover.”

However, Alvarado acknowledged that the legislation resulted from compromise.

The bill originally would have prohibited interest charges on new or unpaid medical debt. While in the Senate Law and Justice Committee, it was changed to a 1% interest rate.

During a floor debate Feb. 6, the Senate approved an amendment proposed by Sen. Judy Warnick, R-Moses Lake, that would make the 1% interest rate applicable only to new medical debt accrued after Dec. 31, 2026.

Despite this, Republicans expressed concerns about the policy’s impact on small, rural hospitals.

Sen. Keith Wagoner, R-Sedro Woolley, introduced a floor amendment that would keep the 1% interest rate for debt charged by large multihospital health systems, but increase the interest rate to 4% for debt charged by smaller hospitals.

Republicans argued that this higher interest rate is necessary to give struggling rural hospitals the revenue they need to stay alive.

“This amendment hopes to get a more nuanced approach that really reflects the realities of what’s happening and the differences between the hospital systems that we have: large systems versus small, rural [ones],” Wagoner said.

Alvarado pushed back.

“[The amendment] distinguishes and sets different interest rates based on where you got your care,” she said. “And I believe that people shouldn’t pay more just because they went to a rural hospital. I recognize that those hospitals may be struggling, but families are struggling, too.”

The Senate did not adopt the proposed amendment.

While Sen. John Braun, R-Centralia, said he has empathy for those struggling with medical debt, he emphasized that interest rates are not about penalizing people.

“The bottom line is, there is a cost when these medical services are provided,” he said, “and the question is, who’s going to cover the cost?”

Braun warned that the bill may force hospitals in rural areas to close.

“You know what’s worse than struggling to pay for medical [care]?” he said. “It’s not having access at all.”

Sen. Ron Muzzall, R-Oak Harbor, said he can’t see his rural hospital staying open “with just that one more thing that is stacked against their ability to stay in business and offer those services.”

The Senate voted to pass SB 5993 along party lines with a 29-19 vote, with one excused. It is now under consideration in the House.

The Washington State Journal is a nonprofit news website operated by the WNPA Foundation. To learn more, go to wastatejournal.org.