San Juan County earned the honors of best county in Washington state for small business owners in 2020, according to a recent SmartAsset study. The county was eighth overall.

Nearly 43% of tax-filing island residents reported having an income from a personal small business, and 14.3% of the total income in the county was from small businesses.

The study analyzed the percentage of the population who reported small-business income; the percentage of small-business income to the total income of the islands; and an estimate of local and federal income taxes for the county based on the national median household income. SmartAsset is a financial technology company connecting consumers with financial advice and services.

On April 6, Economic Development Council of San Juan County Executive Director Victoria Compton gave a presentation to the San Juan County Council on the status of the county’s economy following the widespread shutdowns caused by the COVID-19 pandemic.

“The last year has been a gobsmacked in terms of ups and downs and excitement. At the beginning of the economic decline last year, we saw a drop in GDP of 32.9% on the national scale, which was pretty unprecedented,” Compton said, noting that San Juan County saw a massive spike in unemployment claims due to the shutdowns. “Our unemployment figures were staggering. … You probably already knew that.”

Compton pointed to two spikes in unemployment data — one from when the lockdowns began and another when business owners and contractors were allowed to apply. The rest of the year, however, was a “low rumble,” she said.

San Juan County has always had a cyclical economy, Compton said, describing it as “Boomy in the summer, busty in the winter.”

So far, the recovery seen in 2021 has been better than was anticipated, Compton explained, but it’s still not comparable to previous years.

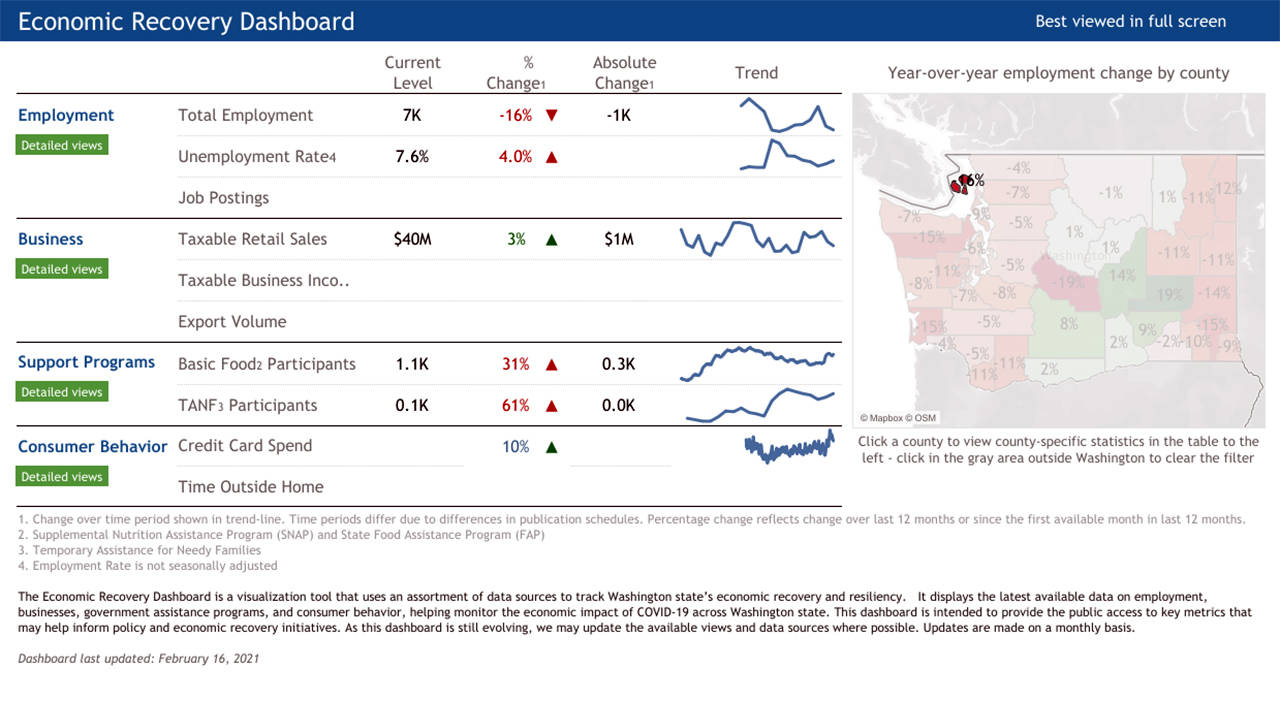

While total employment in San Juan County was still down in February 2021 compared to 2020, Compton explained taxable retail sales and hotel tax has been slowly increasing.

“That’s also helping a touch,” Compton said.

Reliance on social safety net programs Basic Food and Temporary Assistance for Needy Families is up 31% and 61% respectively.

The service industry — leisure and hospitality especially — was highly affected by the shutdowns, experiencing a loss of nearly 72% of its employees due to shutdowns. The percentage of county residents who are entrepreneurs remains high, however.

“We have a very highly entrepreneurial county, where 30% of our denizens are self-employed. We have a lot of employment in micro-businesses which is 1-to-9 employees, almost 45%,” Compton said. “So it’s an interesting way to look at the county as a very entrepreneurial, bootstrapping county.”

Overall, 3,627 island residents applied for unemployment insurance, according to Compton.

“Which is colossal,” she said.

Island industries such as manufacturing, construction, and information and financial activities gained employment during the pandemic, Compton explained.

Meanwhile, the EDC offered an array of economic recovery programs from the beginning of the pandemic.

“When we saw what was happening in February and March of last year, we immediately rolled out significant programming to try to help,” Compton said.

The EDC offered one-on-one counseling seven days a week in March and June of 2020; business health and safety regulation outreach; unemployment insurance for business owners, outreach and counseling; conducted a business recovery call weekly; hosted a business “Chat ‘n’ Chew” twice weekly; held weekly Community Forums; assisted in grant and loan application assistance programs; and significantly updated its website, social media accounts released a twice-weekly newsletter.

“We [facilitated] a tremendous volume of pandemic grants through the EDC,” Compton said, adding the council also made connections with various community entities and leaders. “Just to make sure that we were understanding everything that was happening and so that they heard from us near constantly.”

The EDC facilitated nearly $800,000 in grants, helping more than 400 businesses and being directly responsible for at least 474 county jobs being retained, according to Compton. Additionally, more than $41 million in Paycheck Protection Program funds were distributed to San Juan County businesses, she said.

County Council Member Cindy Wolf asked if what she’s heard about a shortage of island employees is just temporary or a permanent problem.

“It’s really a combo platter,” Compton said, noting there are people who earn more on unemployment; those who are high-risk and scared to return to work until they’re fully vaccinated; and those who left the islands altogether. “It’s a tough combination, and a lot of it we really don’t have control over.”