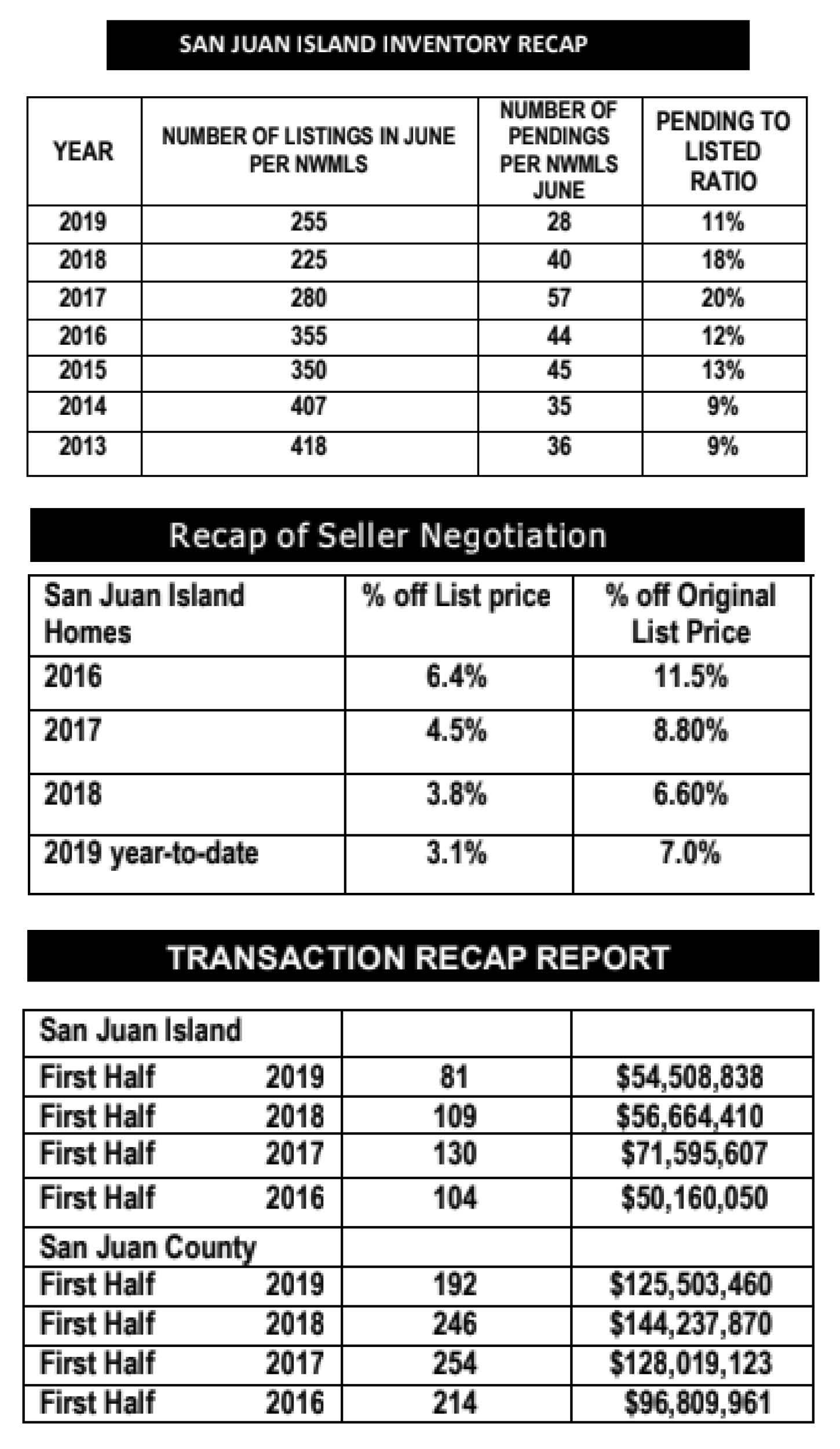

The second quarter results which complete the first half of the year for San Juan Island were similar to the first quarter. Per the NWMLS, the dollar volume on San Juan Island was $54,508,838 with a total of 81 transactions. The numbers reflect a 4% decrease in dollar volume and a 26% decrease in the number of transactions as compared to the same period in 2018. However, it was a slight improvement over the period of 2017 to 2018 when the volume decrease for the same period was 22% and the decrease for the number of transactions was 18%. For San Juan County, the total dollar volume was $125,503,460 with a total of 192 transactions. The County’s decrease in volume was 13% with a 22% decrease in the number of transactions.

So, the elephant in the room is that San Juan Island’s 2018 year-end figures reflected a decrease in volume and in the number of transactions. San Juan County ended the year with a flat volume level and a decrease in number of transactions. Obviously, when the 2018 information is combined with the first half of the year results, it demonstrates a continued slow-down in our volume and sales. Why?

Interest rates are good, regional employment is fabulous and our local prices didn’t over-heat. Per the NWMLS report, the state is robust but moving from a “hyper-market” in some areas to one where a correction is underway compared to last year. Further the report states many Counties are experiencing increases in prices and an increase in medium home price, but they note year-over-year decreases area-wide in both the volume of new listings and closed sales. They state that 50% of the areas are robust. We are not one of the robust areas.

As of July 5th, we have 255 properties listed with 28 under contract or 11%. These figures reflect a higher inventory level but lower pending ratio as compared to the same period in 2018. Some categories of listings are low in inventory but there is an ample number of properties for buyers to select from in most segments of our pricing.

In our market, when a home is priced at or slightly below market, we have noted some multiple offers and the price might have even been bid up. However, most of our sellers still need to negotiate with a buyer to reach an agreeable contract. Year-to-date, 49 sellers for homes listed under $1M have negotiated on average of 2.8% at time of sale. For the same group of property owners, 18 or 36% had to lower from their original price an average of 5% to attract a buyer. Those homes were on the market for an average of 157 days which is fewer days than the average in 2018.

Sellers for homes in excess of $1M, of which there were 9 on San Juan, negotiated on average 3.9% off list price. Those same property owners reduced their price from their original list price before attracting a buyer an average of 2.8%. Those homes were on the market for an average of 119 days. I made the executive decision to remove the Miller property on Roulac Road from the data calculations in this paragraph and chart below as it skewed the numbers terribly. Due to the uniqueness of the property, that seller negotiated 14.6% off list price and had to reduce the price 23% before attracting a buyer. The home sold for $8.5M.

Landowners in all of the price ranges, have negotiated on average 14% off list price on San Juan year-to-date. They reduced their prices from the original list price on average 2.3% before attracting a buyer.

Ultimately, the pricing decision is always the sellers and it is based on their motivation levels. They often obtain an opinion of value from at least one broker, if not more, which aids in their decision process. In an upward trending market, most sellers price against inventory versus sold comparable properties. In a correcting or slower market, sellers should price based on how long they want the property to be on the market. Sellers should consider the average days on market for other similar properties as part of the process.

If a seller overprices or fails to have the property in good condition, it will only cost them time and money. Sellers can’t afford to be tuned out to what the market is saying.

It is positive that the average percentages negotiated off list price have continued to decrease over the last few years.

The medium home price for the last 12-month period ending 6-30-2019 on San Juan is $535,000 and the average was $731,744. This is compared to $506,500 for the median and $687,300 for the average for the 12-month period ending 6-30-2018. The median and average for land sales also reflects an increase over 2018. This explains the fewer number of transactions as the individual sale amounts are higher. This is not a calculation of appreciation but merely a trend; a good one, at that.

Sales in excess of more than $1M have always played a role in our San Juan County market. Year-to-date, we have closed 23 compared to 30 last year same period. We have 11 pending versus 13 last year same period. We currently have 112 active listings in this category.

“The Why?” to this market is a puzzle to me so I will attribute it to a regional correction. However, I will note that the volume and transaction numbers are down but the high producing agents, just as last year, are doing very well. I have personally closed more sales volume this year as compared to last and I know the individual volume is strong for many agents on San Juan and Orcas.

I propose that when the volume is lower, some agents continue to make things happen.

Advice: Summer is the most active time of the year in our market

Buyer’s Advice: Rates are down, inventory has increased and offers a great selection plus, our prices are decent.

Seller’s Advice: Fewer more discriminating buyers so you need to price at market.

If you have any questions about our real estate market, please be sure to contact me.